Banking Tech Forecast: Cloudy, With a Chance of Cyber Risk

Data Breach Today

JULY 4, 2023

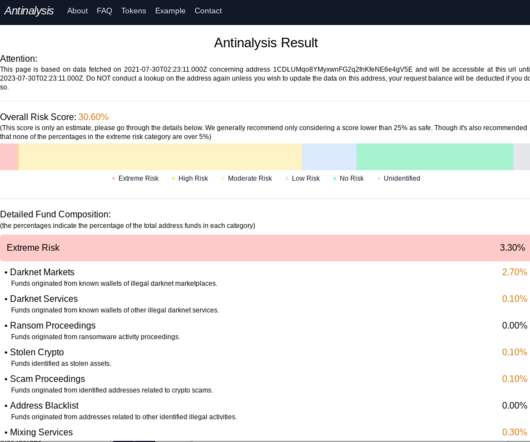

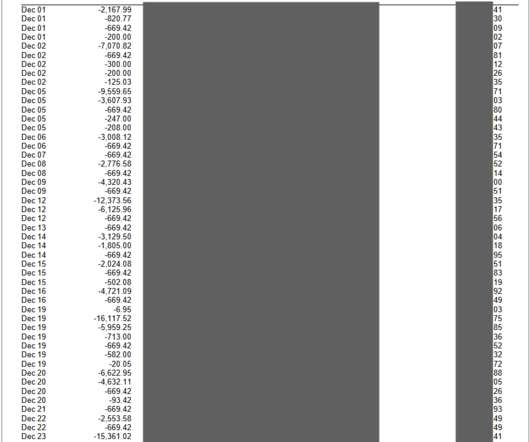

Cloud Adoption in Financial Services has Soared - as Has Security Risk Financial services organizations face unique cloud security challenges, due to special regulatory, data security and privacy considerations that don't necessarily apply to other industries.

Let's personalize your content