Top predictions for financial services in 2023

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

Security Affairs

OCTOBER 14, 2020

The payment of ransoms demanded by these criminals can incentivize further malicious cyber activity; benefit malign actors and fund illicit activities; and present a risk of money laundering, terrorist financing, and proliferation financing (ML/TF/PF), and other illicit financial activity.” ” continues the statement.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

OpenText Information Management

OCTOBER 1, 2024

OpenText is presenting the Financial Services Summit 2024 , which taking place on Oct. This exclusive in-person event focuses on harnessing AI to enhance trust and regulatory compliance in the financial services industry. For more information and registration, visit OpenText Financial Services Summit.

Security Affairs

MAY 2, 2020

Upon clicking on the link, users will be presented with a button asking them to log in to Microsoft Teams. In one attack analyzed by the experts, threat actors sent phishing messages to employees containing a link to a document on a domain used by an established email marketing provider to host static material used for campaigns.

Security Affairs

JULY 31, 2024

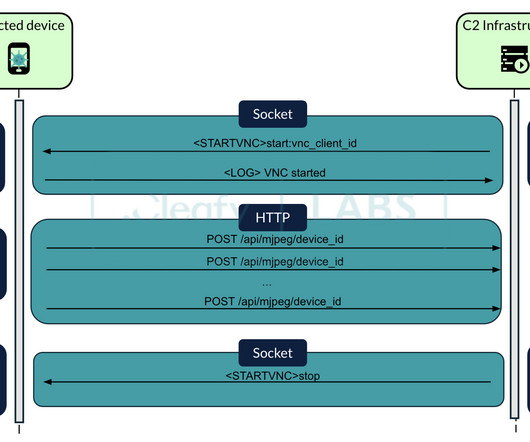

. “These techniques have several advantages: they require less skilled developers, expand the malware’s target base to any bank, and bypass various behavioural detection countermeasures put in place by multiple banks and financial services.”

Security Affairs

APRIL 30, 2020

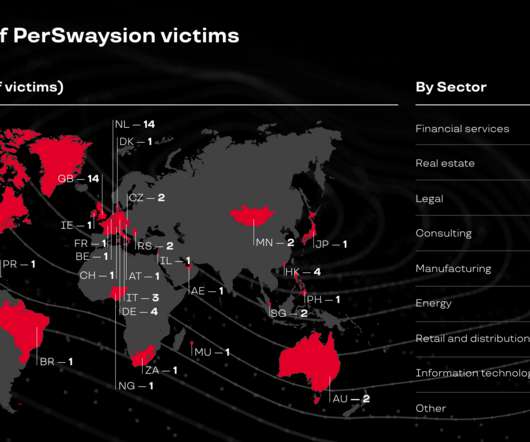

ybercriminals behind the PerSwaysion campaign gained access to many confidential corporate MS Office365 emails of mainly financial service companies, law firms, and real estate groups. However, this is a specially crafted presentation page which abuses Sway default borderless view.

Security Affairs

NOVEMBER 19, 2018

Other participants were teams from universities, Tencent, financial service provider Ant Financial, and independent researchers. The highest reward is $200,000 that was paid out to participants that presented an iPhone X jailbreak and a remote code execution exploit.

Krebs on Security

SEPTEMBER 29, 2021

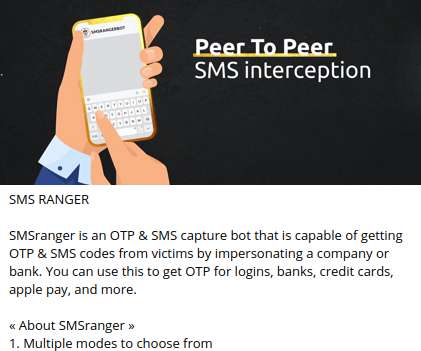

. “Over the past few months, we’ve seen actors provide access to services that call victims, appear as a legitimate call from a specific bank and deceive victims into typing an OTP or other verification code into a mobile phone in order to capture and deliver the codes to the operator.

OpenText Information Management

FEBRUARY 6, 2023

Have you ever been presented with stack of financial documents plastered with sticky notes and felt confused about where to sign and overwhelmed by the wording? consumer duty for the financial services industry appeared first on OpenText Blogs.

OpenText Information Management

JUNE 6, 2018

In a recent blog, I wrote about the increasing prominence of AI in financial services. It’s one of the areas I’ll be presenting on at this year’s OpenText™ Enterprise World, our annual customer conference. The other session I’ll be holding is around customer experience.

Krebs on Security

APRIL 28, 2020

.” The couple have long had their credit cards on auto-payment, and the most recent payment was especially high — nearly $4,000 — thanks to a flurry of Christmas present purchases for friends and family. But it said that surge also brought with it an influx of fraudsters looking to capitalize on all the chaos.

The Last Watchdog

MAY 23, 2023

Mobile apps work by hooking into dozens of different APIs, and each connection presents a vector for bad actors to get their hands on “API secrets,” i.e. backend data to encryption keys, digital certificates and user credentials that enable them to gain unauthorized control.

Data Matters

SEPTEMBER 20, 2018

Office of the Comptroller of the Currency (OCC) announced its decision (the Fintech Charter Decision) to begin accepting applications from financial technology (fintech) companies for special purpose national bank charters. The Fintech Charter Decision is discussed in greater detail in a prior Sidley Banking and Financial Services Update.

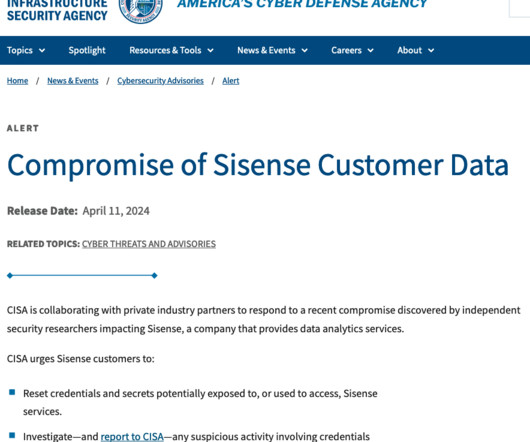

Krebs on Security

APRIL 11, 2024

New York City based Sisense has more than 1,000 customers across a range of industry verticals, including financial services, telecommunications, healthcare and higher education. ” “We are taking this matter seriously and promptly commenced an investigation,” Dash continued.

Thales Cloud Protection & Licensing

NOVEMBER 4, 2020

Financial Services Organizations Need to Adapt their Security Practices to the Shifting Environment. Even “traditional banks” seek to drive more revenue from digital products, personalized services and experiences. At the same time, financial services organizations need to adapt to a shifting global environment.

Hunton Privacy

APRIL 22, 2020

On April 13, 2020, the New York Department of Financial Services (“NYDFS”) issued guidance (“April guidance”) to all New York State entities covered under NYDFS’s cybersecurity regulation regarding assessing and addressing heightened cybersecurity risks due to the COVID-19 pandemic.

IBM Big Data Hub

APRIL 4, 2024

This shift is a significant change in their business models, moving from a capital expenditure approach to an operational expenditure approach, allowing financial organizations to focus on their primary business. IBM Cloud Framework for Financial services is uniquely positioned for that, meeting all these requirements.

Data Matters

AUGUST 19, 2020

On July 21, 2020, the New York State Department of Financial Services (NYDFS or the Department) issued a statement of charges and notice of hearing (the Statement) against First American Title Insurance Company (First American) for violations of the Department’s Cybersecurity Requirements for Financial Services Companies, 23 N.Y.C.R.R.

AIIM

MARCH 3, 2020

Too often I hear one of two, equally bad answers: Keep Records for Seven years: This seems to be the de facto answer, especially for financial services records. Internal Revenue Service rules around when they can audit individual and corporate tax returns. As near as I can tell, this comes from the U.S. BIG DATA!!!

Security Affairs

JULY 30, 2019

Experts spotted a Java ATM malware that was relying on the XFS (EXtension for Financial Service) API to “ jackpot ” the infected machine. In that case, the malware was relying on the XFS (EXtension for Financial Service) API to “ jackpot ” the infected machine. Introduction.

Security Affairs

APRIL 20, 2023

ICICI Bank leaked millions of records with sensitive data, including financial information and personal documents of the bank’s clients. ICICI Bank, an Indian multinational valued at more than $76 billion, has more than 5,000 branches across India and is present in at least another 15 countries worldwide.

Security Affairs

JUNE 20, 2023

These challenges are intensified in industries that handle large volumes of sensitive data under stringent regulations , such as financial services, healthcare, and government sectors. The evolving threat landscape presents additional challenges, including the rise of sophisticated cyberattacks.

Security Affairs

SEPTEMBER 12, 2018

Other SAP products addressed with the Security Notes are Business One, BEx Web Java Runtime Export Web Service, HANA, WebDynpro, NetWeaver AS Java, Hybris Commerce, Plant Connectivity, Adaptive Server Enterprise, HCM Fiori “People Profile” (GBX01HR), Mobile Platform, Enterprise Financial Services, and Business One Android application.

IBM Big Data Hub

JULY 31, 2023

Financial services companies are considered institutions because they manage and move the core aspects of our global economic system. And the beating heart of financial institutions is the IBM mainframe. Atruvia AG is one of the world’s leading banking service technology vendors.

The Last Watchdog

NOVEMBER 9, 2020

In one very recent caper, the attackers targeted the CFO of a financial services firm, as he worked from home, Sherman says. Automatic trust is no longer an option IoT system intrusions present a clear and present danger beyond the healthcare sector, of course. This is not just all up to the company.

The Last Watchdog

SEPTEMBER 18, 2024

This year’s awards were presented across 33 categories, celebrating both established industry leaders and emerging innovators. ” The SC Awards are presented by SC Media, a trusted cybersecurity resource, and evaluated by a panel of independent industry experts.

Schneier on Security

JANUARY 31, 2024

The rules would ensure people can obtain their own financial data at no cost, control who it’s shared with and choose who they do business with in the financial industry. The best way for financial services firms to meet the CFPB’s rules would be to apply the decoupling principle broadly.

The Last Watchdog

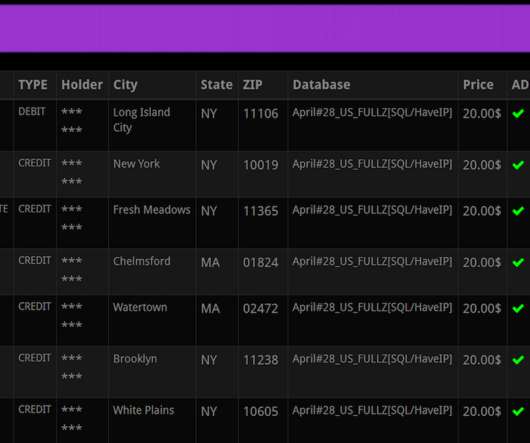

JANUARY 30, 2019

Turn the corner into 2019 and we find Citigroup, CapitalOne, Wells Fargo and HSBC Life Insurance among a host of firms hitting the crisis button after their customers’ records turned up on a database of some 24 million financial and banking documents found parked on an Internet-accessible server — without so much as password protection.

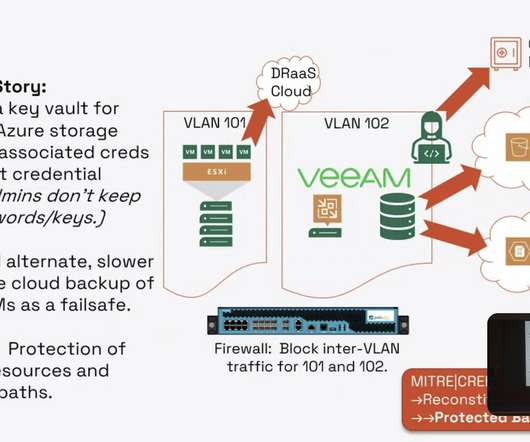

eSecurity Planet

NOVEMBER 17, 2022

The answer, based on a couple of presentations at the conference, is that patching is incredibly difficult to get right, requiring way more attention than most companies can afford to give it. Art Ocain, VP for Cybersecurity and Incident Response at Airiam, noted that the managed security services provider patches as often as 10 times a day.

John Battelle's Searchblog

OCTOBER 11, 2014

Sometimes it’s an unscripted, wide ranging conversation (like during Advertising Week , for example), but other times it’s a formal presentation, which means many hours of preparation and reportage. These more formal presentations are opportunities to consolidate new thinking and try it out in front of a demanding audience.

Collibra

OCTOBER 31, 2023

With business and technology leaders from around the globe exploring how data fuels the industry, and presentations on everything related to accelerating financial data pipelines and delivering data in the cloud, the event offered executive thought leadership on emerging technologies. Already using AI?

Krebs on Security

OCTOBER 7, 2022

who in April 2022 opened an investigation into fraud tied to Zelle , the “peer-to-peer” digital payment service used by many financial institutions that allows customers to quickly send cash to friends and family. Elizabeth Warren (D-Mass.), Bank , and Wells Fargo.

Krebs on Security

FEBRUARY 9, 2023

report from 2016 said investigators from Mikhaylov’s unit and Kaspersky Lab were present at the film company raid]. Also charged with treason was Ruslan Stoyanov , then a senior employee at Russian security firm Kaspersky Lab [the Forbes.ru This is not the U.S. government’s first swipe at the Trickbot group.

Collibra

MAY 16, 2022

For financial services, data governance found its roots in risk. As CROs prioritized Operational Risk post the 2007 financial crisis, those leaders also looked to centralized thought like the Basel Accords. How can a tool that is meant to audit the effectiveness of data quality also perform its own service effectively?

Collibra

JULY 6, 2022

We haven’t even mentioned compliance challenges, which are especially significant in highly regulated industries like healthcare and financial services. > Across business units, your colleagues spend too much time and effort trying to understand data, its relationships, and how to make it useful. Get the ebook. Get your copy today.

Thales Cloud Protection & Licensing

JANUARY 11, 2023

This webinar presents key findings from the 2022 Thales Cloud Security Study. Security & Compliance for SAP Data in Financial Services. Financial services companies keep some of their most valuable data in SAP applications, triggering the need for both additional security and taking steps toward meeting compliance requirements.

The Last Watchdog

MARCH 26, 2019

Pick any company in any vertical – financial services, government, defense, manufacturing, insurance, healthcare, retailing, travel and hospitality – and you’ll find employees, partners, third-party suppliers and customers all demanding remote access to an expanding menu of apps — using their smartphones and laptops.

The Last Watchdog

DECEMBER 12, 2023

No critical findings were present among the Top 30 vulnerabilities for the Internet Software (or SaaS) industry, as defined by the public security scoring system CVSS. Additionally, 75% of the total vulnerabilities regularly scanned by Detectify, primarily crowdsourced from its community of ethical hackers, don’t have a CVE assigned.

The Last Watchdog

MAY 17, 2021

The summer of 2019 was a heady time for the financial services industry. For a full drill down on our conversation please give the accompanying podcast a listen. Here are the key takeaways: Cloud migration risks. Hunting vulnerabilities.

Data Matters

SEPTEMBER 12, 2018

As part of the public discussion, the Commission, the European Securities and Markets Authority (ESMA), the European Banking Authority (EBA) and the UK Financial Conduct Authority (FCA) were present to provide their thoughts. Firms interested in cryptoassets should watch for EU regulatory guidance later this year.

Hunton Privacy

NOVEMBER 25, 2020

The Collective Redress Directive was presented in April 2018 by the European Commission and is part of the European Commission’s New Deal for Consumers. The Collective Redress Directive was proposed as a response to several scandals related to breaches of consumers’ rights by multinational companies.

OpenText Information Management

MAY 22, 2024

As we prepare for one of the most important events in payments, we understand that the financial services industry is undergoing significant changes, driven by standards like ISO 20022 and the rapid adoption of artificial intelligence. We are excited to be a lead sponsor at the 2024 Payments Canada Summit!

Data Matters

AUGUST 22, 2018

On August 7, a group of regulators from 11 jurisdictions published a consultation (the Consultation) on the Global Financial Innovation Network (the GFIN), which aims to promote international cooperation on innovation and the use of technology in financial services (FinTech) and in regulatory processes (RegTech).

IT Governance

AUGUST 26, 2021

For example, financial services firms may be worried about employees breaching insider trading laws. If you’re unable to make it, the video will be available to download from our website shortly after the presentation. The webinar takes place on 1 September 2021, from 4:00 pm.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content