Top predictions for financial services in 2023

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

IBM Big Data Hub

DECEMBER 1, 2023

Insurers struggle to manage profitability while trying to grow their businesses and retain clients. Large, well-established insurance companies have a reputation of being very conservative in their decision making, and they have been slow to adopt new technologies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Security Affairs

APRIL 20, 2023

ICICI Bank leaked millions of records with sensitive data, including financial information and personal documents of the bank’s clients. ICICI Bank, an Indian multinational valued at more than $76 billion, has more than 5,000 branches across India and is present in at least another 15 countries worldwide.

Data Matters

AUGUST 19, 2020

On July 21, 2020, the New York State Department of Financial Services (NYDFS or the Department) issued a statement of charges and notice of hearing (the Statement) against First American Title Insurance Company (First American) for violations of the Department’s Cybersecurity Requirements for Financial Services Companies, 23 N.Y.C.R.R.

The Last Watchdog

JANUARY 30, 2019

Turn the corner into 2019 and we find Citigroup, CapitalOne, Wells Fargo and HSBC Life Insurance among a host of firms hitting the crisis button after their customers’ records turned up on a database of some 24 million financial and banking documents found parked on an Internet-accessible server — without so much as password protection.

The Last Watchdog

MARCH 26, 2019

Pick any company in any vertical – financial services, government, defense, manufacturing, insurance, healthcare, retailing, travel and hospitality – and you’ll find employees, partners, third-party suppliers and customers all demanding remote access to an expanding menu of apps — using their smartphones and laptops.

Data Protection Report

JANUARY 30, 2023

educational enrollment or opportunity; e. employment opportunities; f. financial or lending services; g. health-care services; h. housing; or i. insurance. The other four requirements were already present in New York’s General Business Law § 399-z. 7. a (Yes).

HL Chronicle of Data Protection

MAY 13, 2019

In the past two years, multiple state bills that have been introduced in the US to provide for cybersecurity requirements and standards to the insurance sector, with recent legislative activity taking place in particular within the States of Ohio, South Carolina, and Michigan. NYDFS: Setting a new bar for state cybersecurity regulation.

eSecurity Planet

FEBRUARY 11, 2022

The simplest example may be insurance. Life, health, auto, and other insurance are all designed to help a person protect against losses. Risk management is a concept that has been around as long as companies have had assets to protect. Maintaining Regulatory Compliance.

Data Matters

DECEMBER 28, 2020

The National Association of Insurance Commissioners (NAIC) held its Fall 2020 National Meeting (Fall Meeting) December 3-9, 2020. NAIC Adopts the Group Capital Calculation Template and Instructions and Related Revisions to the Insurance Holding Company Act. Insurance groups will be exempt from filing a GCC if. groups to non-U.S.

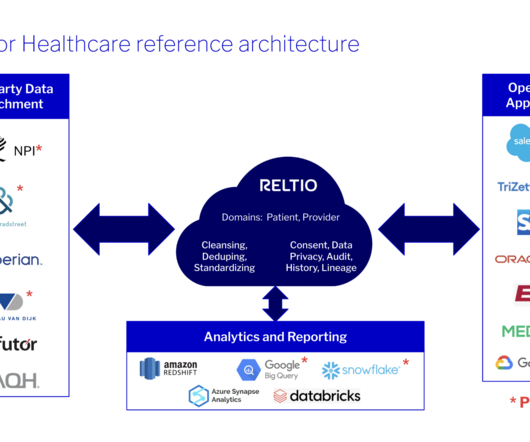

Reltio

FEBRUARY 23, 2023

Health insurance companies need an accurate view of providers to enable better patient experience, such as a best-in-class physician finder. The rising adoption of value-based care models has presented significant data challenges for healthcare providers. Providers need to adopt value-based care to get money from insurance companies.

KnowBe4

MARCH 28, 2023

At present, the most important area of relevance around AI for cybersecurity is content generation. I've written quite a few times about specific cyber insurance claim cases that required going to court to settle. I've written quite a few times about specific cyber insurance claim cases that required going to court to settle.

Collibra

JANUARY 27, 2022

The long awaited International Financial Reporting Standard (IFRS-17) is finally upon us – coming into effect on January 1, 2023. IFRS-17 is one of the most consequential accounting standards enacted in decades for the recognition, measurement, presentation and disclosure of insurance contracts. Why is IFRS-17 important?

Data Matters

SEPTEMBER 4, 2019

The National Association of Insurance Commissioners (NAIC) held its Summer 2019 National Meeting (Summer Meeting) in New York City from August 3 to 6, 2019. The amended regulation took effect on August 1, 2019, for annuity products and will become effective on February 1, 2020, for life insurance products.

Info Source

MAY 30, 2024

The company is targeting an enterprise version of Docfai at legal, insurance, financial services, auditing and merger and acquisition type applications. According to a presentation for potential investors, Ripcord was on target for $22.5 Ripcord plans to introduce a paid tier of Docufai at some point this year.

Hunton Privacy

MARCH 16, 2017

Sotto on the new cybersecurity regulations from the New York State Department of Financial Services (“NYDFS”). Sotto points out that these regulations will “affect companies far and wide,” including “any vendor that touches a New York banking, insurance or financial organization.”.

Info Source

JANUARY 30, 2025

While 2025 will still present challenges, there is light at the end of the tunnel. However, the training, customisation, and deployment of Large Language Models (LLMs) present major challenges related to their energy consumption. Digital transformation itself supports circular economy initiatives.

Lenny Zeltser

JUNE 21, 2024

Further down were CISOs at financial services or insurance firms. Typically, these costs are covered by vendor sponsorships, which allow vendors to present, advertise, and otherwise expand their brand equity. For such presentations, the organizers often require that the speaker not be in sales or marketing.

IT Governance

NOVEMBER 13, 2023

On 14 September, Mulkay discovered that the compromised files contained personal information, including “name, address, date of birth, Social Security number, driver’s license number or state ID, medical treatment information, and health insurance information”. Records breached: 79,582 Ontario hospitals update: information relating to 5.6

Collibra

MAY 14, 2021

This conference brought together data and analytics leaders from top industries such as government, banking, financial services, insurance, and manufacturing. Gartner emphasized and reiterated the concept of adaptation in a number of presentations. Last week I attended the virtual Gartner Data and Analytics Summit.

eSecurity Planet

JUNE 16, 2022

Capital markets, insurance, financial services, and banking are now online. This presents a unique opportunity for cyber criminals. With the rise of the digital economy, e-wallets, cryptocurrencies, and digital assets, the way the world does business has transformed.

eSecurity Planet

OCTOBER 5, 2021

Banking, financial services, and insurance industries constitute the largest share of adopters, with North America leading adoption, according to Orbis Research. Security experts advise IT professionals to protect the entire information pipeline since even fourth-party vendors can present a security risk.

Info Source

JULY 16, 2019

ABBYY is currently present in most countries in Asia with long-established offices in Taiwan and Japan and through its strong partner network. ABBYY has long been active in the Asia-Pacific markets with many successful large-scale implementations in banking and financial services, insurance, telecom, government, and other verticals.

IBM Big Data Hub

JANUARY 18, 2024

Reduce operational costs and boost efficiency Chatbots present the option to reduce 24×7 staffing expenses or even eliminate after-hours staffing costs, provided your chatbots can effectively handle most questions. As a result, when a live agent takes over, much of the anger has already dissipated, preventing potential rudeness or abuse.

eSecurity Planet

FEBRUARY 16, 2021

Healthcare and financial services are the most attacked industries. While the above vendors present mostly pre-attack protection tools, additional vendors are starting to offer rapid response to ransomware. Ransomware facts. Losses for business averaged $2,500 per incident, and ransom demands average $13,000 ( Comparitech ).

Info Source

FEBRUARY 11, 2020

It ultimately presents this data and their relationships in enterprise knowledge graphs to fuel process automation and decision-making. solutions include mortgage origination, healthcare patient records, employee onboarding, tax form and insurance claims processing.

Info Source

JANUARY 29, 2019

The plaque was presented to recognize Newgen for their partnership and to thank them for visiting the new Kodak Alaris Experience Center in Rochester, NY (USA). Diwakar Nigam, Newgen Managing Director and CEO, receives a special plaque from Mr. Don Lofstrom, President and General Manager, Alaris, a Kodak Alaris business. ROCHESTER, N.Y.,

Hunton Privacy

NOVEMBER 10, 2016

Telecommunication and technology companies were the most represented respondents, followed by insurance and financial services companies, as well as pharmaceutical and healthcare companies. and less than half operate in South America and Asia.

Data Matters

NOVEMBER 2, 2021

Building off an existing futures trading relationship and its documentation presents advantages for the institutional investment manager. Some of the larger, well-known cryptocurrency market participants and service providers are beginning to offer institutional versions of their products to investment managers and their funds.

Everteam

APRIL 2, 2019

ImageFast is an award-winning consulting and technical services company that has been delivering information governance solutions to the insurance and finance markets for over 20 years. “We Spigraph is also pleased to announce ImageFast as a reseller of the Everteam Information Governance products. About Everteam.

Privacy and Cybersecurity Law

MARCH 23, 2018

These low results for cyber preparedness and resiliency present a significant risk for business. 34% assess device and system interconnectivity and vulnerability across the business ecosystem.

eSecurity Planet

JANUARY 21, 2021

LogicManager’s GRC solution has specific use cases across financial services, education, government, healthcare, retail, and technology industries, among others. Insurance & claims management. Then, you can download relevant data sets and export them as spreadsheets, PDFs, or presentations. LogicManager. Back to top.

Info Source

DECEMBER 8, 2023

The lack of Telecoms infrastructure and digital skill development presents a hurdle; however, where investments by local government or overarching organisations close the gap, they will enable in particular economies with young populations. Generative AI solutions present an important opportunity for the integration in IDP solutions.

eSecurity Planet

JANUARY 21, 2021

LogicManager’s GRC solution has specific use cases across financial services, education, government, healthcare, retail, and technology industries, among others. Insurance & claims management. Then, you can download relevant data sets and export them as spreadsheets, PDFs, or presentations. LogicManager. Back to top.

IBM Big Data Hub

FEBRUARY 23, 2024

Banking and financial services: AI-driven solutions are making banking more accessible and secure, from assisting customers with routine transactions to providing financial advice and immediate fraud detection. Conversational AI is also making significant strides in other industries such as education, insurance and travel.

IBM Big Data Hub

APRIL 18, 2024

Image (55%): Gen AI can simulate how a product might look in a customer’s home or reconstruct an accident scene to assess insurance claims and liability. Education Imagine an AGI tutor who doesn’t present information but personalizes the learning journey. The skills gap in gen AI development is a significant hurdle.

HL Chronicle of Data Protection

MARCH 14, 2019

The proposed Rule would require FIs to take reasonable steps to select and retain service providers that are capable of maintaining appropriate safeguards for customer information and to periodically assess service providers based on risk they present.

Data Matters

SEPTEMBER 24, 2019

In Barbados, the public consultation on a draft privacy bill has already taken place and an amended bill has been presented to a Joint Select Committee of both Houses of the Barbados Parliament on May 31, 2019. The BDPA was passed by the BDPA on July 24, 2019 and now awaits the Governor-General’s signature. An Overview of the BDPA.

Data Matters

JANUARY 2, 2018

At present, litigation of this type has typically failed at the pleadings stage due to plaintiffs’ failure to demonstrate the “injury in fact” necessary for Article III standing. State legislatures, insurance commissions, attorneys general and regulatory agencies are moving to develop detailed cybersecurity requirements.

DLA Piper Privacy Matters

APRIL 2, 2020

Working remotely, or “teleworking,” presents unique cybersecurity challenges to the employer, the employee and the supply chain, especially when being done for the first time in a rapidly changing environment. This may be the fastest and most disruptive technological shift in global work conditions in history.

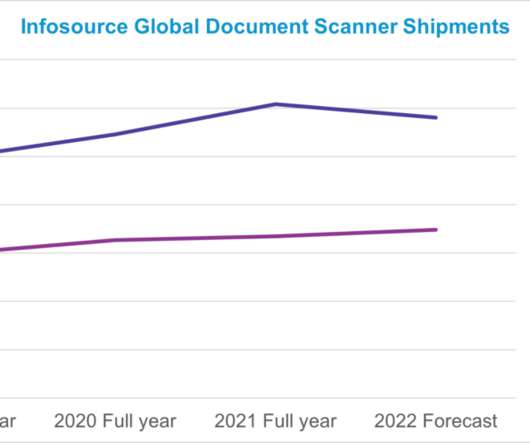

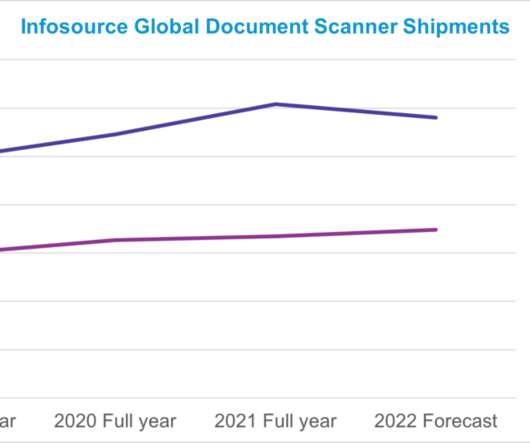

Info Source

MARCH 16, 2022

That said, a significant number of transactional business inputs continue to arrive in paper form and need to be digitized before they can be processed, which presents a challenge in a home office environment. Infosource analysts track both Capture Software and Capture Hardware devices.

HL Chronicle of Data Protection

SEPTEMBER 12, 2018

The series builds on the CCPA overview we recently presented via webinar. We will explore the ramifications for businesses of this seminal legislation in this multi-part series, The Challenge Ahead, authored by members of Hogan Lovells’ CCPA team. provide additional CCPA analyses and reports. provide additional CCPA analyses and reports.

Info Source

MARCH 16, 2022

That said, a significant number of transactional business inputs continue to arrive in paper form and need to be digitized before they can be processed, which presents a challenge in a home office environment. Infosource analysts track both Capture Software and Capture Hardware devices.

Cyber Info Veritas

JULY 19, 2018

This is according to a recent survey conducted by Soha Systems, and according to one of the speeches delivered by the Superintendent of the New York State Department of Financial Services, Mr. Benjamin Lawsky, “ A company’s cybersecurity is only as strong as the cybersecurity of its third-party vendors ”.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content