Top predictions for financial services in 2023

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

Collibra

OCTOBER 31, 2023

With business and technology leaders from around the globe exploring how data fuels the industry, and presentations on everything related to accelerating financial data pipelines and delivering data in the cloud, the event offered executive thought leadership on emerging technologies. Already using AI?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Collibra

JULY 6, 2022

We haven’t even mentioned compliance challenges, which are especially significant in highly regulated industries like healthcare and financial services. > > See how adaptive data and analytics governance can help. At Collibra, we believe it’s the next big step forward in data governance. Get the ebook.

Security Affairs

JUNE 20, 2023

Data sovereignty also encompasses the rights and regulations governing data storage, processing, and transfer and often intersects with privacy, security, and legal considerations. The evolving threat landscape presents additional challenges, including the rise of sophisticated cyberattacks.

IBM Big Data Hub

OCTOBER 4, 2022

Today, AI presents an enormous opportunity to turn data into insights and actions, to amplify human capabilities, decrease risk and increase ROI by achieving break through innovations. Customers, employees and shareholders expect organizations to use AI responsibly, and government entities are demanding it. The solution: AI Governance.

AIIM

MARCH 3, 2020

Too often I hear one of two, equally bad answers: Keep Records for Seven years: This seems to be the de facto answer, especially for financial services records. Internal Revenue Service rules around when they can audit individual and corporate tax returns. As near as I can tell, this comes from the U.S. BIG DATA!!!

IBM Big Data Hub

APRIL 4, 2024

This shift is a significant change in their business models, moving from a capital expenditure approach to an operational expenditure approach, allowing financial organizations to focus on their primary business. IBM Cloud Framework for Financial services is uniquely positioned for that, meeting all these requirements.

Security Affairs

APRIL 20, 2023

ICICI Bank leaked millions of records with sensitive data, including financial information and personal documents of the bank’s clients. ICICI Bank, an Indian multinational valued at more than $76 billion, has more than 5,000 branches across India and is present in at least another 15 countries worldwide.

Data Matters

AUGUST 19, 2020

On July 21, 2020, the New York State Department of Financial Services (NYDFS or the Department) issued a statement of charges and notice of hearing (the Statement) against First American Title Insurance Company (First American) for violations of the Department’s Cybersecurity Requirements for Financial Services Companies, 23 N.Y.C.R.R.

Krebs on Security

FEBRUARY 9, 2023

Department of the Treasury says the Trickbot group is associated with Russian intelligence services, and that this alliance led to the targeting of many U.S. companies and government entities. report from 2016 said investigators from Mikhaylov’s unit and Kaspersky Lab were present at the film company raid].

Collibra

MAY 16, 2022

For financial services, data governance found its roots in risk. As CROs prioritized Operational Risk post the 2007 financial crisis, those leaders also looked to centralized thought like the Basel Accords. Audit & Professional Services. Consider the examples from our peer industries: Operational Risk.

Schneier on Security

JANUARY 31, 2024

The rules would ensure people can obtain their own financial data at no cost, control who it’s shared with and choose who they do business with in the financial industry. The best way for financial services firms to meet the CFPB’s rules would be to apply the decoupling principle broadly.

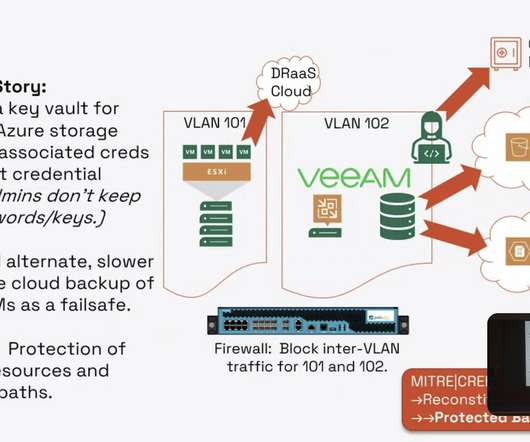

eSecurity Planet

NOVEMBER 17, 2022

The answer, based on a couple of presentations at the conference, is that patching is incredibly difficult to get right, requiring way more attention than most companies can afford to give it. Art Ocain, VP for Cybersecurity and Incident Response at Airiam, noted that the managed security services provider patches as often as 10 times a day.

The Last Watchdog

JANUARY 30, 2019

Turn the corner into 2019 and we find Citigroup, CapitalOne, Wells Fargo and HSBC Life Insurance among a host of firms hitting the crisis button after their customers’ records turned up on a database of some 24 million financial and banking documents found parked on an Internet-accessible server — without so much as password protection.

erwin

DECEMBER 20, 2018

The driving factors behind data governance adoption vary. Whether implemented as preventative measures (risk management and regulation) or proactive endeavors (value creation and ROI), the benefits of a data governance initiative is becoming more apparent. Defining Data Governance. www.erwin.com/blog/defining-data-governance/.

Thales Cloud Protection & Licensing

OCTOBER 28, 2024

It aims to ensure that financial institutions, ranging from banks to payment processors, can manage and mitigate risks associated with information and communication technology. Key areas covered by DORA include incident reporting, regular ICT risk assessments, third-party risk management, and maintaining robust governance frameworks.

The Last Watchdog

MARCH 26, 2019

Pick any company in any vertical – financial services, government, defense, manufacturing, insurance, healthcare, retailing, travel and hospitality – and you’ll find employees, partners, third-party suppliers and customers all demanding remote access to an expanding menu of apps — using their smartphones and laptops.

eSecurity Planet

JANUARY 21, 2021

Governance, risk, and compliance (GRC) software helps businesses manage all of the necessary documentation and processes for ensuring maximum productivity and preparedness. Third-party governance. IT governance and security. Privacy governance and management. Enterprise & operational risk management. Audit management.

IT Governance

AUGUST 26, 2021

For example, financial services firms may be worried about employees breaching insider trading laws. If you’re unable to make it, the video will be available to download from our website shortly after the presentation. The post The compliance challenges of hybrid working appeared first on IT Governance UK Blog.

erwin

DECEMBER 17, 2020

The same is true for data, with a number of vendors creating data models by vertical industry (financial services, healthcare, etc.) The CDM provides a best-practices approach to defining data to accelerate data literacy, automation, integration and governance across the enterprise. The CDM takes this concept to the next level.

Thales Cloud Protection & Licensing

NOVEMBER 20, 2023

The IBM 2023 Cost of a Data Breach Report , for example, highlights the continuous financial burden on retailers, which, coupled with potential reputational damage, emphasizes the dire need for retailers to prioritize and bolster their cybersecurity measures. Governments: Look to global benchmarks.

Data Protection Report

JULY 5, 2021

The Commission is assessing the application of the Trade Secrets Directive in the context of the data economy, including a study focusing on four key sectors (automotive, health, energy and financial services) with a view to providing clarifying guidance at a later date. What are the policy options? Data Act Consultation.

eSecurity Planet

FEBRUARY 11, 2022

Some organizations such as financial services firms and healthcare organizations, have regulatory concerns in addition to business concerns that need to be addressed in a cybersecurity risk management system. Also read : Top Governance, Risk, and Compliance (GRC) Tools for 2022. Maintaining Regulatory Compliance.

Everteam

APRIL 2, 2019

To support organizations in their efforts to manage their information properly, Spigraph is making two Everteam governance products available: everteam.discover and everteam.policy: everteam.discover is a file and content analytics solution that connects to both structured and unstructured data repositories across the organization.

IBM Big Data Hub

MAY 9, 2023

Today, AI presents an enormous opportunity to turn data into insights and actions, to help amplify human capabilities, decrease risk and increase ROI by achieving break through innovations. It drives an AI governance solution without the excessive costs of switching from your current data science platform.

Info Source

JANUARY 30, 2025

While 2025 will still present challenges, there is light at the end of the tunnel. E-invoice mandates require invoice data to be submitted following a defined standard to a government portal, which in most geographies also serves as a repository for the invoice data. Digital transformation itself supports circular economy initiatives.

The Last Watchdog

OCTOBER 29, 2019

Long-run damage Data Theorem has won customers from the financial services and technology sectors that are routinely creating dozens of new APIs per day. Each API in the field represents a clear and present leak point. This is all part of leveraging microservices to deliver slicker user experiences.

Data Protection Report

MAY 24, 2024

Accountability and governance. The AI update was published alongside a speech by chief executive Nikhil Rathi announcing the FCA’s plans to focus on Big Tech and Feedback Statement FS24/1 on data asymmetry between Big Tech and firms in financial services. These principles (the Principles) are: Safety, security and robustness.

Troy Hunt

SEPTEMBER 27, 2024

This isn't just a cat forum; it is a repository of credentials that will unlock social media, email, and financial services. Of course, it's not the fault of the breached service that people reuse their passwords, but their breach could lead to serious harm via the compromise of accounts on totally unrelated services.

Collibra

MAY 14, 2021

This conference brought together data and analytics leaders from top industries such as government, banking, financial services, insurance, and manufacturing. Gartner emphasized and reiterated the concept of adaptation in a number of presentations.

DLA Piper Privacy Matters

APRIL 26, 2021

These are technologies anticipated to present significant risk of harm and so permitted only on a restricted basis, with specific controls in place to support safe use. It may be expanded in the future to cover other AI systems which the EC consider to present similarly high risks of harm. Governance, enforcements and sanctions .

Collibra

JULY 9, 2024

The initial staff retraining and the cost of migration are real barriers to an updated, cloud-based data governance system. Prior to adopting Collibra , the Baptist Health data governance team encountered frequent frustrations with the organization’s legacy on-premises storage systems.

Collibra

JANUARY 27, 2022

IFRS-17 is one of the most consequential accounting standards enacted in decades for the recognition, measurement, presentation and disclosure of insurance contracts. It will encompass risk management, actuarial valuation, asset liability management and financial reporting practices. Why is IFRS-17 important?

Info Source

JULY 16, 2019

ABBYY is currently present in most countries in Asia with long-established offices in Taiwan and Japan and through its strong partner network. ABBYY has long been active in the Asia-Pacific markets with many successful large-scale implementations in banking and financial services, insurance, telecom, government, and other verticals.

eSecurity Planet

JUNE 16, 2022

These new attacks affect everything from private citizens and businesses to government systems; healthcare organizations; public services; and food, water, and fuel supply chains. Capital markets, insurance, financial services, and banking are now online. This presents a unique opportunity for cyber criminals.

eSecurity Planet

JANUARY 21, 2021

Governance, risk, and compliance (GRC) software helps businesses manage all of the necessary documentation and processes for ensuring maximum productivity and preparedness. Third-party governance. IT governance and security. Privacy governance and management. Enterprise & operational risk management. Audit management.

Collibra

JUNE 16, 2021

Every year I am honored to present the Collibra Excellence Awards at our flagship conference, Data Citizens. Established the Collibra Data Governance Center as the standard tool for data governance and metadata, and created the Collibra Operational Group at Freddie Mac to promote Collibra as the enterprise tool for data governance.

Info Source

MAY 8, 2019

The summit featured presentations by Alaris senior executives, marketing teams and strategic partners. Event highlights included a solutions expo with a series of interactive demos of real-world solutions for government, healthcare and financial services.

Data Protection Report

JANUARY 6, 2020

The New York State Department for Financial Services regulations require covered entities to have appropriate record retention policies and procedures and the CCPA provides an extra incentive to implement proper information governance to minimise the costs data access requests. In the U.S.,

IT Governance

NOVEMBER 13, 2023

The post The Week in Cyber Security and Data Privacy: 6 – 12 November 2023 appeared first on IT Governance UK Blog. According to BleepingComputer , the ALPHV/BlackCat ransomware group took responsibility for an attack on McLaren’s network on 4 October. “DP In the meantime, if you missed it, check out last week’s round-up.

IBM Big Data Hub

APRIL 11, 2024

A cloud-based infrastructure that uses IBM Cloud® for Financial Services can be the answer to ensure the security, privacy and flexibility needed to keep up with these changes in the industry. How can IBM help?

IBM Big Data Hub

FEBRUARY 5, 2024

The Digital Operational Resilience Act (DORA) marks a significant milestone in the European Union’s (EU) efforts to bolster the operational resilience of the financial sector in the digital age.

Data Matters

NOVEMBER 2, 2021

Building off an existing futures trading relationship and its documentation presents advantages for the institutional investment manager. Some of the larger, well-known cryptocurrency market participants and service providers are beginning to offer institutional versions of their products to investment managers and their funds.

IBM Big Data Hub

OCTOBER 16, 2023

Data sovereignty addresses legal, privacy, security and governance concerns associated with the storage, processing and transfer of data. Establish data governance frameworks, policies, procedures and tools by organizations to bring in required control and audit.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content