Top predictions for financial services in 2023

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

Data Matters

FEBRUARY 25, 2022

Sidley and OneTrust DataGuidance are pleased to announce that registration is now open for their annual Data Protection in Financial Services (DPFS) Week. Join us from February 28 – March 3 for DPFS Week 2022 , a series of webinars looking at the impacts of data privacy across the financial sector.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Data Breach Today

DECEMBER 31, 2020

Financial services commentator Chris Skinner explains why state governments and AML concerns are to blame. Facebook's relaunch and rebrand of its Libra digital payment initiative as Diem is seen by some as a shadow of its former self.

IBM Big Data Hub

FEBRUARY 26, 2024

The financial services industry has been in the process of modernizing its data governance for more than a decade. But as we inch closer to global economic downturn, the need for top-notch governance has become increasingly urgent. The post 6 benefits of data lineage for financial services appeared first on IBM Blog.

Dark Reading

OCTOBER 10, 2023

Financial services organizations migrating applications to the cloud need to think about cloud governance, applying appropriate policies and oversight, and compliance and regulatory requirements.

Data Protection Report

NOVEMBER 8, 2023

On November 1, 2023, the New York Department of Financial Services (“NYDFS”) released the finalized amendments of Part 500 of its cybersecurity regulations. The Amendment also includes new governance requirements and responsibilities applicable to the CISO of all covered entities.

CGI

APRIL 17, 2020

Embracing new ways of working in financial services. Although the approaches to dealing with the COVID-19 pandemic vary by country, as governments and businesses come to grips with it, one thing is imperative: we will get through this. . The question is how, when disruptions in day-to-day life and business abound.

DLA Piper Privacy Matters

NOVEMBER 18, 2021

Should data privacy be embraced as a business opportunity now, rather than viewed as a business risk only for many in this sector?

AIIM

NOVEMBER 3, 2020

More and more records managers in state and local government operations tell me that their job is changing. Marni is a member of the AIIM Leadership Council and an expert in ECM and Digital Transformation with a focus on Healthcare, Financial Services, and state and local government operations. What can you do?

The Last Watchdog

FEBRUARY 25, 2019

based supplier of identity access management (IAM) systems, which recently announced a partnership with Omada, a Copenhagen-based provider of identity governance administration (IGA) solutions. Governance and attestation quickly became a very big deal. Compliance became a huge driver for governance and attestation,” Curcio said. “It

Collibra

AUGUST 29, 2024

As financial services organizations continue to advance their data governance programs, they begin to reap substantial rewards in compliance, risk management and business insights. For financial services firms, this data is essential not only for daily operations but also for strategic decision-making.

Rocket Software

MARCH 14, 2022

Analyst firm IDC recently published a Vendor Spotlight report featuring ASG Mobius Content Services (Mobius) and its applications in the financial service and insurance industries. Insurance and financial services are built on trust, so these changes will help organizations differentiate from competition.

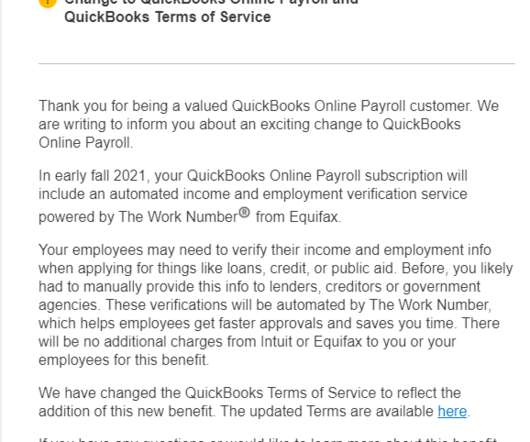

Krebs on Security

JULY 1, 2021

Financial services giant Intuit this week informed 1.4 Intuit says the change is tied to an “exciting” and “free” new service that will let millions of small business employees get easy access to employment and income verification services when they wish to apply for a loan or line of credit.

Collibra

OCTOBER 31, 2023

With every financial services organization focused on making better and faster decisions, data professional and business leaders are eager to better understand how AI can facilitate their strategic goals. Financial services orgs, especially those in capital markets, frequently has been on the forefront of generative AI investment.

Collibra

JULY 6, 2022

We haven’t even mentioned compliance challenges, which are especially significant in highly regulated industries like healthcare and financial services. > > See how adaptive data and analytics governance can help. At Collibra, we believe it’s the next big step forward in data governance. Get the ebook.

IBM Big Data Hub

APRIL 4, 2024

IBM has created the solution for this problem with its Financial Services Cloud offering, and its ISV Financial Services validation program, which is designed to de-risk the partner ecosystem for clients. IBM Cloud Framework for Financial services is uniquely positioned for that, meeting all these requirements.

Thales Cloud Protection & Licensing

AUGUST 31, 2022

Financial services continue to lead in cybersecurity preparedness, but chinks appear in the armor. However, all this attention from cyber criminals, as well as regulators and governments, has produced an extremely resilient industry with some of the best cyber security practices of any sector. Thu, 09/01/2022 - 05:15.

IBM Big Data Hub

OCTOBER 4, 2022

Customers, employees and shareholders expect organizations to use AI responsibly, and government entities are demanding it. Failure to meet regulations can lead to government intervention in the form of regulatory audits or fines, damage to the organization’s reputation with shareholders and customers, and revenue loss.

Krebs on Security

JUNE 18, 2021

.” Mark Rasch , also former federal prosecutor in Washington, said the SEC is signaling with this action that it intends to take on more cases in which companies flub security governance in some big way. “It’s a win for the SEC, and for First America, but it’s hardly justice,” Rasch said.

Data Matters

FEBRUARY 10, 2021

On February 4, 2021, the New York Department of Financial Services (NYDFS) issued Circular Letter No. Lacewell stated that cybersecurity is the biggest risk for government and private organizations and described how the Framework is based on “extensive dialogue with industry and experts.”. The Framework. 1 See W.B.

IBM Big Data Hub

SEPTEMBER 20, 2023

When implemented in a responsible way—where the technology is fully governed, privacy is protected and decision making is transparent and explainable—AI has the power to usher in a new era of government services. AI’s value is not limited to advances in industry and consumer products alone.

Security Affairs

MAY 30, 2019

Chinese Cyber-Spies Target Government Organizations in Middle East. Chinese APT group Emissary Panda has been targeting government organizations in two different countries in the Middle East. defense contractors , financial services firms, and a national data center in Central Asia. Pierluigi Paganini.

Data Matters

AUGUST 19, 2020

On July 21, 2020, the New York State Department of Financial Services (NYDFS or the Department) issued a statement of charges and notice of hearing (the Statement) against First American Title Insurance Company (First American) for violations of the Department’s Cybersecurity Requirements for Financial Services Companies, 23 N.Y.C.R.R.

KnowBe4

SEPTEMBER 30, 2024

These attacks opportunistically target organizations across all industries, but the hardest-hit sectors over the past two years have been construction, hospitals and health care, government, IT services and consulting, and financial services.

Hunton Privacy

DECEMBER 4, 2023

On November 28, 2023, the New York Department of Financial Services (“NYDFS”) announced that First American Title Insurance Company (“First American”), the second-largest title insurance company in the United States, would pay a $1 million penalty for violations of the NYDFS Cybersecurity Regulation in connection with a 2019 data breach.

Hunton Privacy

NOVEMBER 23, 2022

On November 9, 2022, the New York Department of Financial Services (NYDFS) released its second, proposed amendments to the Part 500 Cybersecurity Rule. Cybersecurity Governance. The proposed amendments revise several aspects of the draft Cybersecurity Rule amendments released on July 29, 2022.

Security Affairs

NOVEMBER 20, 2021

banking regulators this week approved a rule that obliges banks to report any major cybersecurity incidents to the government within 36 hours of discovery. Major cybersecurity incidents are attacks that impact operations of the victims or the stability of the US financial sector. Follow me on Twitter: @securityaffairs and Facebook.

Data Matters

JANUARY 28, 2022

The advisory was promptly endorsed by the National Cyber Security Centre, a division of Government Communications Headquarters (“GCHQ”), a UK intelligence agency. government, especially in light of ongoing tensions between the U.S. First , all of the reports specifically focus on the threat of Russian state-sponsored cyberattacks.

Security Affairs

OCTOBER 29, 2021

A ransomware attack hit Papua New Guinea ‘s finance ministry and disrupted government payments and operations. Government officials confirmed that Papua New Guinea’s finance ministry was hit by a ransomware attack that disrupted government payments and operations.

Security Affairs

DECEMBER 4, 2023

According to the report released by Resecurity, a Los Angeles-based company protecting Fortune 500 and governments worldwide, the attack against ICBC may be a precursor for significant malicious cyber activity against global financial system. LockBit specifically targeted ICBC Financial Services (ICBC FS), a wholly owned U.S.

Threatpost

JUNE 18, 2020

Trojan Chrome browser extensions spied on users and maintained a foothold on the networks of financial services, oil and gas, media and entertainment, healthcare and pharmaceuticals and government organizations.

Security Affairs

MAY 24, 2023

The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) announced sanctions against four entities and one individual for their role in malicious cyber operations conducted to support the government of North Korea. ” reads the announcement. correspondent or payable-through account sanctions.”

Krebs on Security

JANUARY 25, 2022

MSF said the personal information involved in this incident may have included name, date of birth, government-issued identification numbers (e.g., 14, 2022 breach notification letter from tribal lender Mountain Summit Financial. . According to Buckley LLP , a financial services law firm based in Washington, D.C.,

Hunton Privacy

JANUARY 20, 2023

As financial services authorities move to regulate digital assets in jurisdictions worldwide, the paper highlights the need to bring privacy regulators into the discussion so that data privacy issues affecting blockchain are addressed in tandem. Confidentiality and government access. Individual rights.

Security Affairs

SEPTEMBER 6, 2024

The government expert pointed out that Unit 29155 operates independently from other GRU-affiliated groups like Unit 26165 and Unit 74455. The threat actors targeted critical infrastructure sectors such as government, finance, transportation, energy, and healthcare. Since 2022, the unit focused on disrupting aid efforts for Ukraine.

Krebs on Security

DECEMBER 27, 2019

-based Synoptek is a managed service provider that maintains a variety of cloud-based services for more than 1,100 customers across a broad spectrum of industries , including state and local governments, financial services, healthcare, manufacturing, media, retail and software.

IBM Big Data Hub

JUNE 7, 2022

Governments and regulatory bodies around the world are working to establish safety standards. The proposed rules aim to govern automated valuation models to protect borrowers. As governments recognize and regulate the growing use of AI for crucial decisions, enterprises should prepare proactively. In the U.S.,

Data Matters

MAY 4, 2022

He is one of the few lawyers who has led multiple global responses to data integrity attacks involving the financial services industry. As a counselor, based on his experience in handling data integrity and operationally impactful malware incidents, he is sought out for his advice in the areas of cyber resilience and data governance.

Security Affairs

DECEMBER 26, 2023

Resecurity, a Los Angeles-based cybersecurity company protecting Fortune 100 and government agencies worldwide, has compiled a comprehensive forecast outlining the imminent threats and novel security challenges anticipated in the upcoming year. Cybersecurity company Resecurity has published the 2024 Cyber Threat Landscape Forecast.

Security Affairs

OCTOBER 19, 2023

“As of January 2022, the FBI has identified at least 52 entities across 10 critical infrastructure sectors affected by RagnarLocker ransomware, including entities in the critical manufacturing, energy, financial services, government, and information technology sectors,” reads the FBI’s flash alert.

Data Protection Report

DECEMBER 17, 2020

On 25 November 2020, the European Commission ( EC ) published its proposed Data Governance Regulation (the DGR ), which will create a new legal framework to encourage the development of a European single market for data. What are the objectives of the Data Governance Regulation? This is part one of a series of three blog posts.

Hunton Privacy

AUGUST 15, 2022

On July 29, 2022, the New York Department of Financial Services (“NYDFS”) posted proposed amendments (“Proposed Amendments”) to its Cybersecurity Requirements for Financial Services Companies (“Cybersecurity Regulations”). The risk assessments required by Section 500.9

AIIM

FEBRUARY 22, 2018

Nowhere is this truer than in the financial services sector. Despite this declared importance – 62% say that “Archiving and long-term digital preservation is a key part of our enterprise information governance and management strategy” -- the reality in most financial organizations is very different.

Security Affairs

FEBRUARY 19, 2024

Since January 2020, affiliates utilizing LockBit have targeted organizations of diverse sizes spanning critical infrastructure sectors such as financial services, food and agriculture, education, energy, government and emergency services, healthcare, manufacturing, and transportation.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content