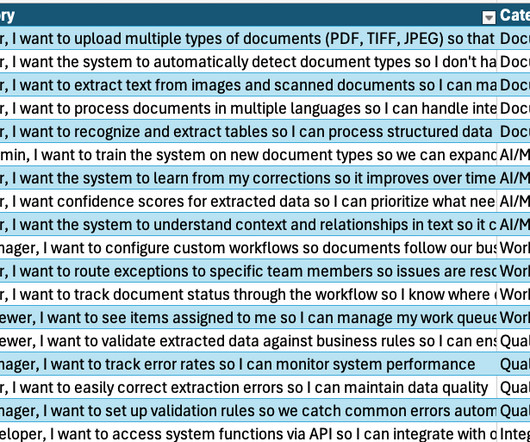

Selecting an Intelligent Document Processing Solution

AIIM

NOVEMBER 14, 2024

Intelligent document processing (IDP) solutions are emerging that combine AI with IDP to revolutionize client and document onboarding and processing.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

AIIM

NOVEMBER 14, 2024

Intelligent document processing (IDP) solutions are emerging that combine AI with IDP to revolutionize client and document onboarding and processing.

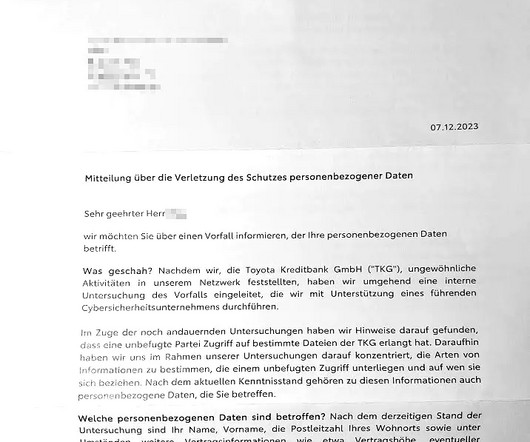

Security Affairs

DECEMBER 11, 2023

Toyota Financial Services (TFS) disclosed a data breach, threat actors had access to sensitive personal and financial data. Toyota Financial Services (TFS) is warning customers it has suffered a data breach that exposed sensitive personal and financial data.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

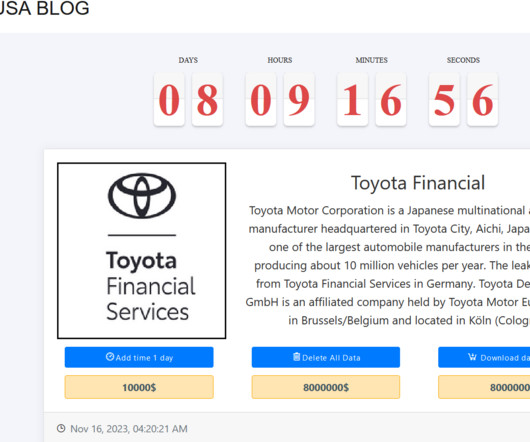

Security Affairs

NOVEMBER 17, 2023

Toyota Financial Services discloses unauthorized activity on systems after the Medusa ransomware gang claimed to have hacked the company. Toyota Financial Services confirmed the discovery of unauthorized activity on systems in a limited number of its locations. The company has yet to disclose a data breach.

Security Affairs

AUGUST 7, 2019

The American group of insurance and financial services companies State Farm disclosed a credential stuffing attack it has suffered in July. The American group of insurance and financial services companies State Farm revealed that it was the victim of a credential stuffing attack it has suffered in July.

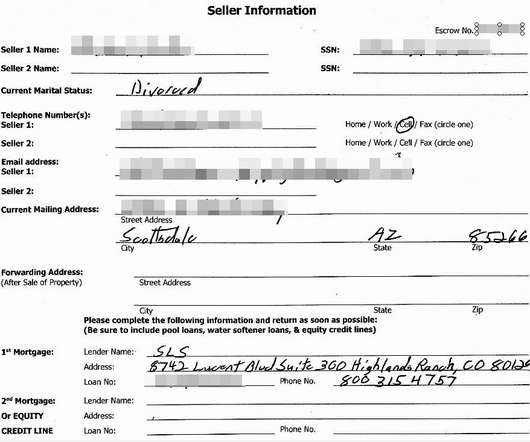

Data Breach Today

JULY 23, 2020

Company Could Be Fined $1,000 for Each Violation of State Cybersecurity Law The New York State Department of Financial Services has filed civil charges against First American Title Insurance Co., which has been accused of exposing hundreds of millions of documents that contained customers' mortgage and personal data.

Krebs on Security

MAY 31, 2019

On May 24, KrebsOnSecurity broke the news that First American had just fixed a weakness in its Web site that exposed approximately 885 million documents — many of them with Social Security and bank account numbers — going back at least 16 years. No authentication was needed to access the digitized records. ”

Krebs on Security

JULY 23, 2020

In May 2019, KrebsOnSecurity broke the news that the website of mortgage title insurance giant First American Financial Corp. based First American [ NYSE:FAF ] is a leading provider of title insurance and settlement services to the real estate and mortgage industries. It employs some 18,000 people and brought in $6.2

Krebs on Security

JUNE 18, 2021

In May 2019, KrebsOnSecurity broke the news that the website of mortgage settlement giant First American Financial Corp. NYSE:FAF ] was leaking more than 800 million documents — many containing sensitive financial data — related to real estate transactions dating back 16 years. This week, the U.S. billion last year.

Security Affairs

AUGUST 20, 2024

In December 2023, Toyota Financial Services (TFS) warned customers it had suffered a data breach that exposed sensitive personal and financial data. Toyota Financial Services (TFS) is the finance arm of the Toyota Motor Corporation.

Rocket Software

MARCH 14, 2022

Analyst firm IDC recently published a Vendor Spotlight report featuring ASG Mobius Content Services (Mobius) and its applications in the financial service and insurance industries. IDP Trends in the Financial and Insurance Industries. Challenges to Effective IDP.

Security Affairs

APRIL 8, 2020

“Many of the ID documents we have on file have expired, but if you believe you provided to HMR IDs that are still valid, report these documents as being compromised to the organisation that issued them.” “Consider contacting CIFAS (the UK’s Fraud Prevention Service) to apply for protective registration. .

OpenText Information Management

JANUARY 12, 2021

Fax is so secure that faxed documents and signatures are recognized in the courts as being legally binding. It stands to reason, then, that fax would be the bedrock of financial communications, but are there ways to make it even better? The paper problem Financial services workflows have always been heavily paper-based.

Hunton Privacy

JUNE 9, 2022

515 , making Vermont the twenty-first state to enact legislation based on the National Association of Insurance Commissioners Insurance Data Security Model Law (“MDL-668”). On May 27, 2022, Vermont Governor Phil Scott signed H.515 Information Security Program Requirements. Enforcement and Penalties Under the Law.

IBM Big Data Hub

DECEMBER 1, 2023

Insurers struggle to manage profitability while trying to grow their businesses and retain clients. Large, well-established insurance companies have a reputation of being very conservative in their decision making, and they have been slow to adopt new technologies.

Krebs on Security

SEPTEMBER 11, 2019

The company that handled that process for MyPayrollHR is a California firm called Cachet Financial Services. On Monday, New York Governor Andrew Cuomo called on the state’s Department of Financial Services to investigate the company’s “sudden and disturbing shutdown.”

Security Affairs

APRIL 20, 2023

ICICI Bank leaked millions of records with sensitive data, including financial information and personal documents of the bank’s clients. If malicious actors accessed the exposed data, the company could have faced devastating consequences and put their clients at risk, as financial services are the main target for cybercriminals.

Data Matters

AUGUST 19, 2020

On July 21, 2020, the New York State Department of Financial Services (NYDFS or the Department) issued a statement of charges and notice of hearing (the Statement) against First American Title Insurance Company (First American) for violations of the Department’s Cybersecurity Requirements for Financial Services Companies, 23 N.Y.C.R.R.

Data Protection Report

FEBRUARY 2, 2024

On January 17, 2024 the New York Department of Financial Services (“NYDFS”) published a Proposed Insurance Circular Letter (“Proposed Circular”) regarding the use of artificial intelligence systems (“AIS”) and external consumer data and information sources (“ECDIS”) in insurance underwriting and pricing.

The Last Watchdog

APRIL 3, 2019

Its customer base is comprised of eight of the top 15 banks, four of the top six healthcare insurance and managed care providers, nine of the top 15 property and casualty insurance providers, five of the top 13 pharmaceutical companies, and 11 of the largest 15 federal agencies. Compliance matters. Public trust must be maintained.

Data Protection Report

JUNE 2, 2021

On May 13, 2021, the New York Department of Financial Services (NYDFS) announced a $1.8 million settlement with two related insurance companies, relating to violations of two different requirements of the NYDFS cybersecurity regulation during the period 2018 to 2019. NYDFS Cybersecurity Regulation.

eSecurity Planet

FEBRUARY 11, 2022

The simplest example may be insurance. Life, health, auto, and other insurance are all designed to help a person protect against losses. Documenting and Implementing Procedures. Citrix recommends that organizations have fully documented and implemented procedures for all activities that may create cybersecurity risks.

Data Protection Report

APRIL 22, 2021

On April 14, 2021, the New York Department of Financial Services (NYDFS) announced a $3 million settlement with insurance company National Securities Corp. A threat actor gained access to an employee’s document management system account. NYDFS Cybersecurity Regulation. The second incident occurred in March of 2019.

OpenText Information Management

JULY 9, 2024

The financial services sector, long rooted in traditional methods and complex operations, is experiencing a dramatic transformation. Forget the outdated image of clunky fax machines—today’s digital fax and capture offer a sleek, efficient, and secure way to manage information in the modern financial world.

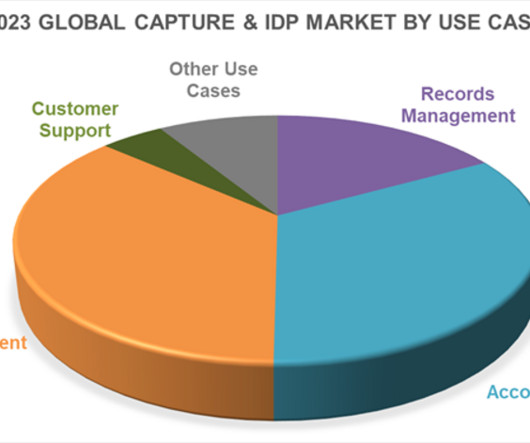

Info Source

SEPTEMBER 26, 2024

CAPTURE & IDP MARKET FRAMEWORK Infosource defines the IDP market as software and services that are used to ingest and process business inputs which involve unstructured documents and other input types. Inputs can include not only documents and other text-based sources, but also voice, photos, videos, and IoT channels.

Hunton Privacy

JULY 24, 2020

On Wednesday, July 22, the New York Department of Financial Services (the “NYDFS”) announced that it had filed administrative charges against First American Title Insurance Co. under the NYDFS Cybersecurity Regulation , marking the agency’s first enforcement action since the rules went into effect in March 2017.

Info Source

JANUARY 30, 2025

1: GenAI's Dual Impact Slowing Growth Before Driving New Opportunities Generative AI (GenAI) is set to revolutionise the Intelligent Document Processing (IDP) market by transforming input ingestion and automating business processes. Following the initial hype and subsequent frustration in 2024, the market growth saw a temporary slowdown.

HL Chronicle of Data Protection

MAY 13, 2019

In the past two years, multiple state bills that have been introduced in the US to provide for cybersecurity requirements and standards to the insurance sector, with recent legislative activity taking place in particular within the States of Ohio, South Carolina, and Michigan. NYDFS: Setting a new bar for state cybersecurity regulation.

Data Matters

DECEMBER 28, 2020

The National Association of Insurance Commissioners (NAIC) held its Fall 2020 National Meeting (Fall Meeting) December 3-9, 2020. NAIC Adopts the Group Capital Calculation Template and Instructions and Related Revisions to the Insurance Holding Company Act. Insurance groups will be exempt from filing a GCC if. groups to non-U.S.

Info Source

MAY 30, 2024

Ralph Gammon, Senior Analyst at Infosource May 2024 Ripcord first came onto our radar in 2017, most notably for innovative high-volume scanners, but it also had some early artificial intelligence (AI) powered technology for providing cloud-based Capture, Intelligent Document Processing (IDP) and Content Services to its outsourcing customers.

Info Source

JUNE 25, 2019

In this evaluation, Kofax was cited as a “Strong Performer” excelling in document automation. With a focus on customer onboarding in complex and regulatory environments like financial services, mortgage generation and insurance, Kofax offers a comprehensive solution”. .

Adam Levin

SEPTEMBER 5, 2019

Don’t authenticate yourself to anyone unless you are in control of the interaction, don’t over-share on social media, be a good steward of your passwords, safeguard any documents that can be used to hijack your identity, and freeze your credit. Monitor your accounts.

Adam Levin

NOVEMBER 30, 2018

If you prefer a more laid back approach, sign up for free transaction alerts from financial services institutions and credit card companies, or subscribe to a credit and identity monitoring program, 3. Monitor your accounts. Check your credit report every day, keep track of your credit score, review major accounts daily if possible.

Data Matters

JUNE 24, 2021

On June 15, 2021, the SEC announced settled charges against First American Title Insurance Company (First American) for disclosure controls and procedures violations related to a cybersecurity vulnerability that exposed sensitive customer information. See CF Disclosure Guidance: Topic No. 2, Cybersecurity (Oct. 14, 2011). 15, 2020).

Data Matters

APRIL 20, 2021

DOL guidance provides a series of questions that should serve as a starting point for this review and includes topics such as the service provider’s information security standards, track record, cybersecurity insurance coverage, and cybersecurity validation techniques.

Data Matters

AUGUST 17, 2021

The Guidance replaces prior FFIEC-issued guidance on risk management practices for financial institutions offering internet-based products: “Authentication in an Internet Banking Environment” (2005) and the “Supplement to Authentication in an Internet Banking Environment” (2011). The 2005 guidance replaced a 2001 version of the same document.

Hunton Privacy

FEBRUARY 6, 2015

Conducted by the SEC Office of Compliance Inspections and Examinations (“OCIE”) from 2013 through April 2014, the examinations inspected the cybersecurity practices of 57 registered broker-dealers and 49 registered investment advisers through interviews and document reviews.

Info Source

MAY 21, 2020

Alfresco noted that with the release of new technical and business integrations, Ephesoft extends the Alfresco Digital Business Platform with powerful artificial intelligence and machine learning-driven document capture arena in ways never been done before, supporting an enterprise’s digital transformation.

Info Source

MARCH 20, 2019

Kofax is the only vendor that delivers a broad set of AI with RPA to meet enterprise automation ambitions including cognitive document automation. Cognitive Document Automation. It’s an unfortunate reality that on average 62% of organizational data that must be managed is unstructured information such as documents.

Info Source

JULY 6, 2023

By Petra Beck, Senior Analyst Capture Software We are often faced with questions like: How do we justify an investment in a Capture or Intelligent Document Processing (IDP) solution? These inputs arrive through different channels in different formats, a significant portion often as paper documents. as quickly as possible.

eSecurity Planet

FEBRUARY 16, 2021

Attackers can fool even sophisticated users into clicking on an invoice they are expecting, or a photograph that is ostensibly from someone they know, or a document that appears to have come from their boss. Healthcare and financial services are the most attacked industries. Block Executables. Ransomware facts. Ransomware Types.

Info Source

APRIL 25, 2019

It creates a completely new frictionless user experience for all onboarding and data entry scenarios like sign-up, registration, and document input, supports organizations’ digital transformation and robotic process automation (RPA) strategies.

Data Protection Report

FEBRUARY 8, 2018

February 15, 2018, is quickly approaching and any entity subject to New York’s cybersecurity regulation (23 NYCRR Part 500) must file its first annual certification of compliance with the New York State Department of Financial Services (DFS) by that date.

Data Matters

NOVEMBER 2, 2021

For institutional investors that trade futures using a futures customer agreement with a registered futures commission merchant, or FCM, this offering can be an appealing way to access digital assets markets because it uses a familiar product and documentation. Traditional OTC Derivatives.

Info Source

JANUARY 24, 2019

Using Vidado Read, enterprises can turn handwritten or printed materials and data into automation-ready information at a fraction of the typical cost.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content