Top predictions for financial services in 2023

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

OpenText Information Management

JANUARY 5, 2023

With inflation, rising interest rates and general economic uncertainty, last year presented several challenges for financial services institutions (FSIs).

Data Matters

FEBRUARY 25, 2022

Sidley and OneTrust DataGuidance are pleased to announce that registration is now open for their annual Data Protection in Financial Services (DPFS) Week. Join us from February 28 – March 3 for DPFS Week 2022 , a series of webinars looking at the impacts of data privacy across the financial sector.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Security Affairs

MAY 24, 2023

The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) announced sanctions against four entities and one individual for their role in malicious cyber operations conducted to support the government of North Korea. ” reads the announcement. correspondent or payable-through account sanctions.”

IBM Big Data Hub

FEBRUARY 26, 2024

The financial services industry has been in the process of modernizing its data governance for more than a decade. But as we inch closer to global economic downturn, the need for top-notch governance has become increasingly urgent. The post 6 benefits of data lineage for financial services appeared first on IBM Blog.

Data Protection Report

NOVEMBER 8, 2023

On November 1, 2023, the New York Department of Financial Services (“NYDFS”) released the finalized amendments of Part 500 of its cybersecurity regulations. The Amendment also includes new governance requirements and responsibilities applicable to the CISO of all covered entities.

Security Affairs

APRIL 6, 2023

A digital identification tool provided by OCR Labs to major banks and government agencies leaked sensitive credentials, putting clients at severe risk. Its services are used by companies and financial institutions including BMW, Vodafone, the Australian government, Westpac, ANZ, HSBC, and Virgin Money.

CGI

APRIL 17, 2020

Embracing new ways of working in financial services. Although the approaches to dealing with the COVID-19 pandemic vary by country, as governments and businesses come to grips with it, one thing is imperative: we will get through this. . Blog moderation guidelines and term of use. Visit cgi.com/3R to learn more. .

Rocket Software

MARCH 14, 2022

Analyst firm IDC recently published a Vendor Spotlight report featuring ASG Mobius Content Services (Mobius) and its applications in the financial service and insurance industries. Insurance and financial services are built on trust, so these changes will help organizations differentiate from competition.

ARMA International

NOVEMBER 7, 2019

The scope of a records and information management (RIM) program in financial services can seem overwhelming. Compared to other industries, the complexities of managing records and information in financial services are arguably some of the toughest to solve, primarily because of the intense regulatory scrutiny.

Security Affairs

APRIL 20, 2023

In 2022, the ICICI Bank’s resources were named a “critical information infrastructure” by the Indian government – any harm to it can impact national security. Cybernews contacted ICICI Bank and CERT-IN, and the company fixed the issue. million files belonging to ICICI Bank.

Collibra

OCTOBER 31, 2023

With every financial services organization focused on making better and faster decisions, data professional and business leaders are eager to better understand how AI can facilitate their strategic goals. Financial services orgs, especially those in capital markets, frequently has been on the forefront of generative AI investment.

Thales Cloud Protection & Licensing

JANUARY 16, 2025

However, as important as PCI may be, United States financial services organizations operate in one of the worlds most stringent and complex compliance landscapes. Understanding the US FinServ Compliance Landscape The US financial services industry is subject to a vast number of laws and regulations.

IBM Big Data Hub

OCTOBER 4, 2022

Customers, employees and shareholders expect organizations to use AI responsibly, and government entities are demanding it. Failure to meet regulations can lead to government intervention in the form of regulatory audits or fines, damage to the organization’s reputation with shareholders and customers, and revenue loss.

Data Protection Report

SEPTEMBER 28, 2021

On 10 September 2021, the UK Government published its consultation paper on proposals to reform the UK’s data protection regime. On legitimate interests, the Government proposes disapplying the legitimate interest balancing test for certain activities. The deadline for responding to the consultation is 19 November 2021.

IBM Big Data Hub

SEPTEMBER 20, 2023

When implemented in a responsible way—where the technology is fully governed, privacy is protected and decision making is transparent and explainable—AI has the power to usher in a new era of government services. AI’s value is not limited to advances in industry and consumer products alone.

Security Affairs

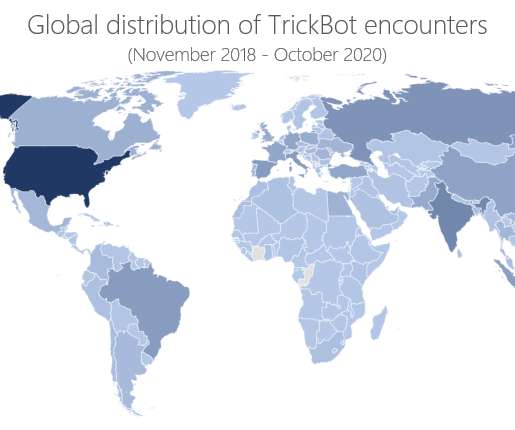

OCTOBER 12, 2020

In this blog, we detail the evolution of Trickbot, associated tactics, recent campaigns, and dive into the anatomy of a specific attack. The information gathered by the security firm was used by Microsoft to receive a warrant to takedown the TrickBot servers. link] — Microsoft Security Intelligence (@MsftSecIntel) October 12, 2020.

Data Matters

FEBRUARY 10, 2021

On February 4, 2021, the New York Department of Financial Services (NYDFS) issued Circular Letter No. Lacewell stated that cybersecurity is the biggest risk for government and private organizations and described how the Framework is based on “extensive dialogue with industry and experts.”. The Framework. 1 See W.B.

IBM Big Data Hub

APRIL 4, 2024

IBM has created the solution for this problem with its Financial Services Cloud offering, and its ISV Financial Services validation program, which is designed to de-risk the partner ecosystem for clients. IBM Cloud Framework for Financial services is uniquely positioned for that, meeting all these requirements.

Data Matters

JANUARY 28, 2022

The advisory was promptly endorsed by the National Cyber Security Centre, a division of Government Communications Headquarters (“GCHQ”), a UK intelligence agency. government, especially in light of ongoing tensions between the U.S. First , all of the reports specifically focus on the threat of Russian state-sponsored cyberattacks.

erwin

DECEMBER 20, 2018

The driving factors behind data governance adoption vary. Whether implemented as preventative measures (risk management and regulation) or proactive endeavors (value creation and ROI), the benefits of a data governance initiative is becoming more apparent. Defining Data Governance. www.erwin.com/blog/defining-data-governance/.

Data Matters

AUGUST 19, 2020

On July 21, 2020, the New York State Department of Financial Services (NYDFS or the Department) issued a statement of charges and notice of hearing (the Statement) against First American Title Insurance Company (First American) for violations of the Department’s Cybersecurity Requirements for Financial Services Companies, 23 N.Y.C.R.R.

Krebs on Security

JANUARY 25, 2022

MSF said the personal information involved in this incident may have included name, date of birth, government-issued identification numbers (e.g., 14, 2022 breach notification letter from tribal lender Mountain Summit Financial. . According to Buckley LLP , a financial services law firm based in Washington, D.C.,

Data Matters

MAY 4, 2022

He is one of the few lawyers who has led multiple global responses to data integrity attacks involving the financial services industry. As a counselor, based on his experience in handling data integrity and operationally impactful malware incidents, he is sought out for his advice in the areas of cyber resilience and data governance.

Data Protection Report

DECEMBER 17, 2020

On 25 November 2020, the European Commission ( EC ) published its proposed Data Governance Regulation (the DGR ), which will create a new legal framework to encourage the development of a European single market for data. This is part one of a series of three blog posts. What are the objectives of the Data Governance Regulation?

The Last Watchdog

MARCH 14, 2022

Financial services, health, home security, governance and all other mission critical services are now provided online. But these accounts are not all about networking and games. Related: What happened to privacy in 2021. COVID crisis has forced us to work remotely. Our children now take classes online.

IBM Big Data Hub

JUNE 7, 2022

Governments and regulatory bodies around the world are working to establish safety standards. The proposed rules aim to govern automated valuation models to protect borrowers. As governments recognize and regulate the growing use of AI for crucial decisions, enterprises should prepare proactively. In the U.S.,

The Last Watchdog

SEPTEMBER 21, 2022

Organizations, such as financial services or government, deal with sensitive information and prefer a private cloud model with greater control over the security of applications, users, and data. and Eastern Europe, which favor public cloud. This is likely because private clouds give organizations more control over data.

Thales Cloud Protection & Licensing

FEBRUARY 28, 2024

How better key management can close cloud security gaps troubling US government madhav Thu, 02/29/2024 - 05:38 In my first blog on this topic I noted a Treasury Department report released last year listed six cloud security challenges financial sector firms face. This hack included US Government networks.

erwin

FEBRUARY 20, 2020

A North American banking group is using erwin Evolve to integrate information across the organization and provide better governance to boost business agility. Developing a shared repository was key to aligning IT systems to accomplish business strategies, reducing the time it takes to make decisions, and accelerating solution delivery.

Thales Cloud Protection & Licensing

DECEMBER 4, 2019

Data security professionals also make ambitious plans, but implementation rates are too low – a key finding in the 2019 Thales Data Threat Report-Financial Services Edition. Here’s a look at four common issues highlighted in the 2019 Thales Data Threat Report-Financial Services Edition and tips for overcoming them.

The Last Watchdog

SEPTEMBER 24, 2024

Governments can create a digital identity at birth to replace SSN in its current use. The NPD breach serves as a stark reminder of the critical importance of data security in today’s digital world, particularly in regulated industries such as financial services and healthcare. That identity is tied to specific vendors.

IBM Big Data Hub

NOVEMBER 7, 2023

Securing sensitive data in an evolving landscape Advancements like those in AI and quantum computing can pose new challenges to customers, especially those in highly regulated industries such as financial services, healthcare, telecommunications and more.

The Last Watchdog

DECEMBER 6, 2018

This cycle takes a holistic approach to detecting and deterring external threats and enforcing best-of-class data governance procedures. Businesses at large would do well to model their data collection and security processes after what the IC refers to as the “intelligence cycle.” infrastructure from cyber attacks.

IBM Big Data Hub

NOVEMBER 14, 2023

With flexible consumption-based pricing, it provides on-demand access to z/OS systems, dramatically improving developer productivity by accelerating release cycles on secure, regulated hybrid cloud environments like IBM Cloud Framework for Financial Services (FS Cloud). The IBM Cloud Framework for Financial Services a.k.a

erwin

APRIL 11, 2019

Some industries, such as healthcare and financial services, have been subject to stringent data regulations for years: GDPR now joins the Health Insurance Portability and Accountability Act (HIPAA), the Payment Card Industry Data Security Standard (PCI DSS) and the Basel Committee on Banking Supervision (BCBS). employees).

OpenText Information Management

JANUARY 24, 2025

This blog covers how traditional IT operations across disciplines such as performance monitoring, observability, configuration management, and service/asset management can contribute to achieving DORA compliance. The post What Every CIO Needs to Know About DORA: An IT Operations Perspective appeared first on OpenText Blogs.

CGI

DECEMBER 11, 2015

Why I believe the Blockchain will transform Government. You may not yet have come across the Blockchain but it is making waves within the financial services community and is heralded as one of the most significant advances in technology for a generation. Blog moderation guidelines and term of use. ravi.kumarv@cgi.com.

OpenText Information Management

NOVEMBER 19, 2024

Designed for industries handling sensitive data - such as healthcare, finance, legal, and government - OpenText’s cloud fax solutions empower global organizations to modernize their fax infrastructure with security and adeptness. Consider a financial services provider handling a high volume of sensitive client information.

Collibra

JULY 14, 2023

Today, we’re excited to announce we’ve attained two new AWS Competencies under the AWS Competency Program: the Data and Analytics Competency, and the Government Competency. Collibra takes immense pride in achieving the AWS Data and Analytics Competency and the AWS Government Competency.

Data Matters

FEBRUARY 11, 2022

Sean’s practice focuses on antitrust and consumer protection litigation and government investigations. Sean, who has spent his entire career handling complex antitrust litigation matters and government investigations, is among the country’s most experienced and highly regarded antitrust lawyers.

erwin

AUGUST 13, 2020

With more governance around the information and processes we use to document that information, we can produce more accurate and robust analyses for a true “as-is” view of the entire organization for better decision-making. We also need to reduce the cost of curating and governing information within our repositories.

erwin

MARCH 18, 2021

The role of chief data officer (CDO) is becoming essential at forward-thinking organizations — especially those in financial services — according to “ The Evolving Role of the CDO at Financial Organizations: 2021 Chief Data Officer (CDO) Study ” just released by FIMA and sponsored by erwin.

erwin

FEBRUARY 7, 2019

As such, traditional – and mostly manual – processes associated with data management and data governance have broken down. The banking, financial services and insurance industry typically deals with higher data velocity and tighter regulations than most. The volume and variety of data has snowballed, and so has its velocity.

IBM Big Data Hub

SEPTEMBER 27, 2022

Whether it be financial services, employee hiring, customer service management or healthcare administration, AI is increasingly powering critical workflows across all industries. AI governance: From principles to actions. Sometimes an organization’s need is more tied to organizational AI governance.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content