Target Sues Insurer Over 2013 Data Breach Costs

Data Breach Today

NOVEMBER 21, 2019

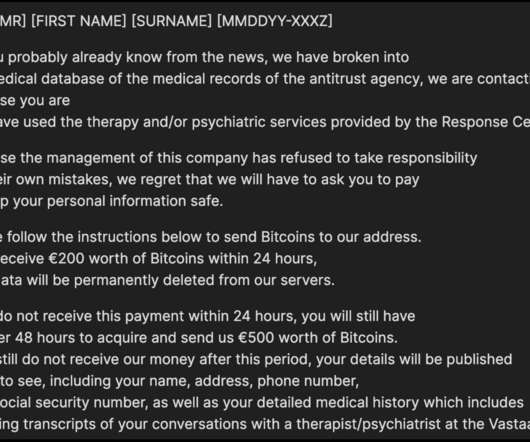

Lawsuit Claims Insurer Owes Retailer for Coverage of Card Replacement Costs Target has filed a lawsuit against its long-time insurer, ACE American Insurance Co., in an attempt to recoup money it spent to replace payment cards as part of settlements over the retailer's massive 2013 data breach.

Let's personalize your content